- Highs: Short contracts compared to competition. Multi-user terminal available. Online payment options. Free next-day settlement.

- Lows: Complaints about auto-renewal and exit fees. Customer service issues. Only integrates with Epos Now. No online reports.

- Choose if: You want the shortest card machine contract and have a high average transaction size.

What is Takepayments?

Takepayments is a UK-based independent sales organisation (ISO) offering card machines, online payments and card processing contracts for small businesses. It is one of the fastest-growing card payment companies in the UK, with 45,000+ merchants under its belt.

The company has been around for over 25 years, previously trading as Payzone. In 2019, it started transitioning into Takepayments for card payment solutions, leaving the brand Payzone to focus on payment hubs for utility bills and services.

Note: There is a different company with bad reviews passing off as “Take Payments Group Ltd” (www.takepayments.co.uk). This article is reviewing “takepayments Limited” (www.takepayments.com), which is a legit company.

Card machines

Takepayments has a card machine for every purpose: one for a fixed till point (Countertop), one to carry around on premises (Portable) and one to use independently on the go (Mobile).

They all accept contactless, chip and PIN and swipe card payments including the mobile wallets Apple Pay, Google Pay and Samsung Pay. Visa, Mastercard and Maestro are accepted as standard, while American Express can be added with an additional agreement.

Countertop card machine

Portable card machine

Mobile card machine

You can print daily transaction reports from any terminal. Otherwise, the only sales reports you get are a monthly statement from your acquirer. There is no online dashboard to log into to manage card machines, view transactions, payouts and account settings. This could be an issue if you need to integrate with Xero or other accounting software.

There is also a smart POS terminal (‘Multipay’) that is both a card payment machine and touchscreen checkout in one portable device. This is geared towards professionals sharing a card machine, as it can be used by six different users with their own logins to distinguish their activities. What’s more, the tipping feature allows you to allocate tips to ensure each merchant gets what they personally earned.

This makes it perfect for barbers, hairdressers, beauticians and hospitality businesses working at the same location but wanting to cut costs by sharing a terminal.

‘Multipay’ card machine

Multipay reconciles transactions in the cloud so individual transactions can be allocated to the right team member. However, only one merchant account and bank account can be attached to the terminal, so in the end, the one and only account holder still has to manually transfer payments to the correct individuals.

The other card machines also record transactions in real time through the cloud, but not with multi-user functionality.The credit card machines can be integrated with the Epos Now till software for a monthly fee and up to three years’ contract. No other POS systems can currently be integrated with Takepayments, which could be an issue for businesses with specific till preferences.

Those requesting a different POS system will have to use the card machines independently alongside the till software, manually confirming transactions on the till after the terminal has processed a card. Later in 2021, Takepayments hopes to offer other EPOS integrations.

Takepayments fees and contract

One of the main draws of Takepayments is the 12-month contract for a card machine package, which is shorter than the typical industry norm of 18-60 months. There is no setup fee, and the company takes pride in stating all fees upfront to avoid surprises later on.

Takepayments will set you up with two contracts:

The exact costs are tailored around the individual business and not listed on the website. Instead, Takepayments encourages you to request a quote through their online form and get a visit from a local sales consultant.

We can, however, state the following costs:

| Takepayments | Pricing |

|---|---|

| Contract length | 12 months |

| Setup fee | None |

| Card machine rental | From £10 + VAT/mo per terminal |

| Merchant account fees | No monthly or annual fees |

| Transaction rates | 0.3%-2.5% (depending on card) + flat fee |

| Monthly minimum charge | £10+/mo |

| PCI compliance | Takepayments fee: £35/yr (optional)Barclaycard fee: £15/mo (mandatory) |

| Chargebacks | £9 each |

| Payouts | Next-day w/Barclaycard: FreeElavon: 30p each |

| Refunds | 30p each |

| Early termination fee | Equivalent to buying out remaining contract |

| Online payments | Annual or monthly fee + transaction charges |

| Take-payments | Pricing |

|---|---|

| Contract length | 12 months |

| Setup fee | None |

| Card machine rental | From £10 + VAT/mo per terminal |

| Merchant account fees | No monthly or annual fees |

| Transaction rates | 0.3%-2.5% (depending on card) + flat fee |

| Monthly minimum charge | £10+/mo |

| PCI compliance | Takepayments fee: £35/yr (optional)Barclaycard fee: £15/mo (mandatory) |

| Chargebacks | £9 each |

| Refunds | 30p each |

| Payouts | Next-day w/Barclaycard: FreeElavon: 30p each |

| Early termination fee | Equivalent to buying out remaining contract |

| Online payments | Annual or monthly fee + transaction charges |

Whereas other acquirers charge monthly and annual fees for card processing, the merchant account from Barclaycard Business has no monthly or yearly account fees. You are only paying fees for card machine transactions, chargebacks, refunds and a monthly PCI-DSS compliance charge to Barclaycard. There’s no charge for the paper statements from the bank.

Transaction charges

Transaction fees are tailored to the merchant’s needs. The main things that determine the card rates are the transaction value and sales volume. If your average transaction value is low, like £5, your quoted fees would be higher than someone accepting high transaction values like £100. This means cafés and convenience stores, for example, probably won’t find that Takepayments is the right fit. Car dealerships, beauticians, restaurants and independent retail shops would, on the other hand, get competitive fees.

Transaction fees are composed of a variable rate associated with the card type/brand, plus a fixed authorisation fee. Takepayments splits the range of fees into four groups: 1) domestic debit cards, 2) domestic credit cards, 3) business debit cards, and 4) business credit cards. Domestic cards have the lowest rate – as low as 0.28% – while a business/corporate card typically costs 1.8%-2% but can go as high as 2.5% plus the fixed authorisation charge.

You can also expect a monthly minimum service charge, which is an agreed amount (say, £20) required in transaction charges every month. If you accept few card machine payments during a month so the total transaction charges are, say, £10, your transaction charges will still amount to £20 in that case.

American Express acceptance requires a separate agreement – it is not automatically accepted until this is set up through your acquirer.

If your average transaction value is low, like £5, your fees would be higher than someone accepting high transaction values like £100. This means cafés and convenience stores, for example, probably won’t be the right fit.

Contract

There’s no cancellation fee if you cancel at least 60 days before the end of the contract. If you don’t give the required notice, it will auto-renew so an early cancellation does apply for the renewed contract. An early exit fee is equivalent to buying out the remaining contract.If your business has to temporarily close due to a Covid-19 lockdown, Takepayments can pause your account for the duration of the closure. If you decide to go for the Epos Now integration, this has a separate contractual commitment of up to three years. We strongly encourage you to check the small print in this contract, as Epos Now is a separate company with their own terms.

Other fees

There’s a monthly fee for card machine rental, the cost of which depends on the card machine model. A stationary card machine costs between £10-£15 + VAT per month in rental, whereas portable or mobile card machines have a higher monthly cost.

PCI-DSS compliance requires a compulsory monthly fee of £15 from the acquirer (Barclaycard) or ongoing non-compliance fee if you don’t complete all the required paperwork within a certain time frame. If you want help managing PCI-DSS compliance, Takepayments can do this for you for an annual fee of £35.

Chargebacks have a fixed fee of £9 each with Barclaycard, while refunds cost 30p to process.

Transactions are settled in your bank account according to your agreed schedule with the acquirer. With Barclaycard, you get next-day settlement for free, whereas a merchant account with Elavon charges 30p per settlement.

Online payments have separate charges, requiring an annual fee upfront or monthly subscription charge for months in arrears. The first 350 transactions per month are included in the price, whereafter you pay 10p per transaction online.

Remote and online payments

Apart from credit card machines, Takepayments has a good range of online payment methods to subscribe to. These include:

Payment gateway: Customisable online checkout page integrated on your website, but hosted by Takepayments. You can get help setting up the online gateway, so hiring a developer isn’t needed. Compatible with 50+ online shopping carts.

Pay by link: Send payment links through email invoices (invoice creation included), customisable email with “pay now” button, or copying and pasting a link into an email. Links take you to a payment page in a web browser.

Virtual terminal: Secure web page where you can enter card details to process a transaction for the cardholder. Used for over-the-phone payments.

These features are accessed from Merchant Management System in any web browser. Here, you can keep track of payments, add users and manage the online payment (not card machine) account in one place.

It is even possible to set up recurring payments or run pre-authorisations on card payments, to verify if someone can pay.

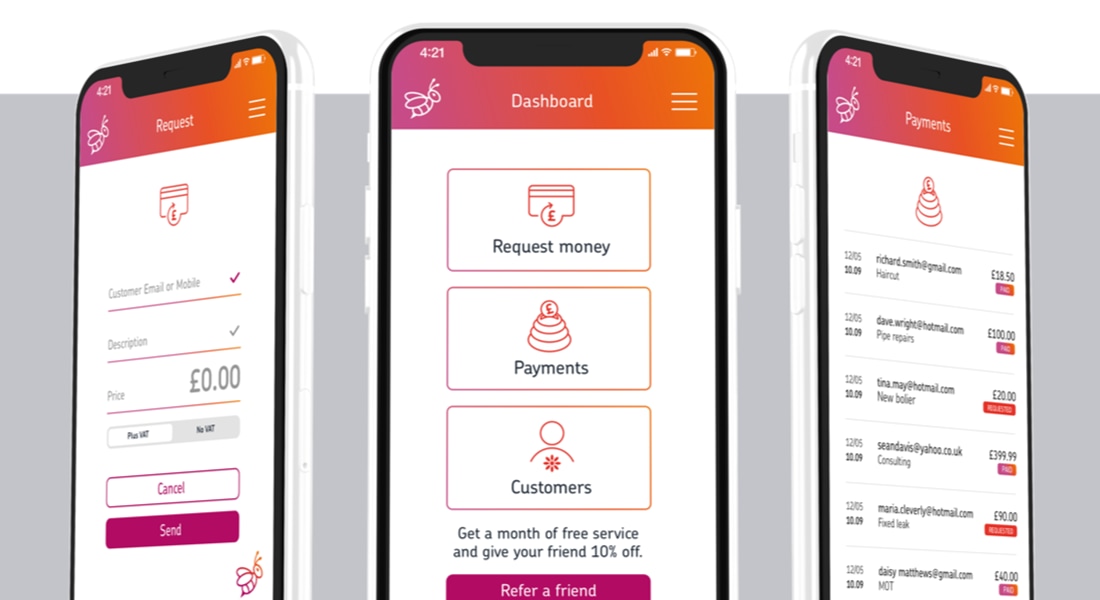

Photo: Takepayments

Beepaid app for sending payment requests (links) to customers.

There are also the two following apps by Takepayments. They are not publicly available through Google Play or App Store. Instead, Takepayments gives you a URL to access for the below features.

‘beepaid’: Lets you send payment requests by email or text message and manage those transactions through the app.

‘order and beepaid’: Includes a personalised web page with your food and drink menu and QR code to print for contactless ordering on your premises. When customers scan it, they can order and pay. Linked to the UK government’s Track and Trace system.

These online payment tools are great for adapting to lockdowns and socially distanced payments. For example, you can set up a delivery or click-and-collect system, contact-free ordering through QR codes or remote payments for self-isolating customers.

Customer service and reviews

Merchants can phone the Takepayments support team every day of the week, but with varying opening hours: 8am-7pm on weekdays, 9am-5pm on Saturdays and Bank Holidays, and 9am-1pm on Sundays. You can also send a letter the old-fashioned way, whereas emailing is only possible in some cases.

There is an online support section for frequently asked questions, but it’s hard to find answers for unique questions since the search function rarely shows results even for keywords that you know are covered.

Epos Now is the only till system that can integrate with Takepayments terminals.

Before you sign up for Takepayments, a dedicated, local consultant will try to come and visit your premises to get to know your business. This is part of the promise that you get a unique package, but some merchants may find it intrusive and pushy.

As for Takepayments reviews, they are mostly positive, but there have been many complaints in the past year. Common themes in the negative reviews include:

Some of these issues can be avoided by getting a copy of the contract to read in your own time before signing up. A 2-month cancellation period is unfortunately common, but Takepayments does highlight it during sign-up.

The sales consultants can reportedly be pushy, in some cases requesting the merchant’s ID before it’s even agreed they want to sign up. We recommend never passing on more details than you’re comfortable with.

That being said, the average Takepayments merchant ends up staying with the company for several years – which we can only take as a good sign.

Our verdict

A year’s contract for card machine rental and card processing is an attractive deal that’s hard to beat elsewhere.

Micro-businesses uncertain about future prospects can benefit from this, but you still need to read your contract’s fine print before agreeing to it. This is to avoid hefty cancellation fees and make peace with the fact that even businesses struggling due to Covid-19 will not get special treatment from Takepayments (apart from contract pauses during lockdowns).

The Multipay card machine is another strength, as card machines do not usually distinguish between payments from multiple different users.

The fees are competitive for a merchant service provider, but Takepayments could do a better job of communicating them on the website. Generally, the sales rep is more communicative than the ongoing support staff.

The Multipay card machine is another strength, as card machines do not usually distinguish between payments from multiple different users.

A downside is the lack of online dashboard for tracking card machine sales remotely or exporting transactions to bookkeeping software. Most other payment providers include this as standard, but Barclaycard (in charge of card processing) has been slow to keep up with technological developments.

The only POS system connecting with the card machines is Epos Now. Even though this is suitable for both hospitality and retail shops, the lack of EPOS choice could be a downside for users with specific preferences.

That said, Takepayments is preferred by businesses that want to avoid long-term commitment beyond a year. The transaction costs are particularly suited for businesses with high-value transactions, and the choice of socially distanced payment methods means you don’t have to look elsewhere to adapt to changing needs.