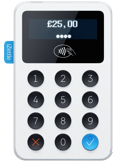

As of 2017 iZettle and SumUp have emerged as the two top runners in the UK market for mobile card readers. With their devices, anyone can turn their smartphone or tablet into a card machine using the processing power of an App.

You can buy the card reader for less than £30, and the silver lining is that there is no fixed monthly fee or rental charge, no minimum contract time, and no minimum card transaction volumes. You just pay a fee per payment you accept.

Their pricing structure and features are somewhat different. Let’s look at the basics of card acceptance and fees first.

|

|

|

| Device price (upfront cost) |

Device price (upfront cost) |

|

Debit/credit card transaction fee |

Debit/credit card transaction fee |

|

Settlement delay |

Settlement delay |

SumUp fees attractive for small merchants

If you are a low volume sole trader with card transactions under £2,000 per month, SumUp might work out cheaper for you. If you take £2,000 per month in card transactions, the monthly cost for SumUp will be £39 and with iZettle £55.

None of them will charge you monthly fees or other charges on top. As we will see below, iZettle offers more features, and also allow you to take more card brands, so whether the saving is worth it, depends on your business.

iZettle will also get the money on your account a bit faster. It will deposit money to your account the business day after the transaction took place. Depending on your bank, the funds may be credited that day or the next day.

The settlement delay for SumUp depends on whether the transaction was with a debit or credit card. Debit cards payments are credited within a day, while credit card payments may take up to three days to show in your account.

iZettle accepts more cards

Both iZette and SumUp allow you to take American Express at no extra cost, which is bargain compared to what a small business would be charged with a merchant account with a providere like Worldpay or SagePay.

With iZettle you can accept Diners Club, JCB and Union Pay on top. For any business dealing with Japanese or Chinese tourists, the two latter are welcome additions.

Selling at the till? Point of sales features

One of the great benefits with iZettle and SumUp compared to a traditional stand alone terminal, is that you get a free ePOS system included in the app. The app works particularly well from a tablet as a touch screen touch register.

We like both apps, but while SumUp reveals reliable German software engineering, iZettle is a joyful combination of functionality and design. The app simply looks and feels great.

The free SumUp app is perfectly fine if you sell simple products or services. With iZettle you can define more attributes, such as weight, colour, and differentiate prices accordingly.

The iZettle app works like touch screen cash register, well designed and intuitive.

With iZettle you can print order tickets, though neither apps allow split tenders, open tickets or tipping. With iZettle you can get all these functions if you upgrade to iZettle with IntelligentPOS.

| Staff accounts Yes, can define information access and authorities |

Staff accounts Yes |

| Product library Yes, elaborate with images |

Product library Yes |

| Expandable to full Point of Sale Yes, with IntelligentPOS (monthly fee) |

Expandable to full Point of Sale Yes (monthly fee) |

| Accounting Excel, CSV reports Xero and Debitoor integration |

Accounting Excel, CSV reports |

| Receipts Print, sms or email |

Receipts Print, sms or email |

| Compatible receipt printers Star Micronics TSP-100 and Bixolon SPP-R200II |

Compatible receipt printers Star Micronics TSP-100 and Bixolon SPP-R200II |

| Elaborate business analytics | Basic business analytics |

Small business accounting

Both iZettle and SumUp has a web backend that gives you a user friendly overview of transaction, and allows you to generate reports. You can export sales history to pdf or Excel for accounting purposes.

iZettle offers better business analytics to dig deeper in your sales, such as how many of each product you have sold, best business days and times for certain products, how much you have given in discounts, cash versus card sales and more. All reports are shown on a user friendly interface.

More and more small UK businesses benefit from affordable and time saving online accounting software. Xero features is hard to beat – invoicing, inventory, payroll, workplace pensions, VAT computation, purchase order and more. iZettle integrates with Xero; SumUp not yet.

A caveat on the iZettle – Xero integration; while the financial side syncs perfectly, the product level does not. This means that if you sell an item with iZettle, the inventory in Xero will not be updated accordingly.

Neither SumUp nor iZettle offer payroll, but with the iZettle – Xero integration you can get payroll in Xero for five employees for the £10 per month (£5 for the basic package per month and £5 for payroll).

iZettle’s cash advance option has been anticipated for small businesses who otherwise struggle to get a small business loan on favourable terms.

iZettle has more to offer growing businesses

With more integrations, a more sophisticated touch screen ePOS app, and more elaborate reports, iZettle could be more attractive for businesses who want to benefit from cloud services beyond payments.

iZettle’s cash advance option has also been anticipated for small businesses who otherwise struggle to get a small business loan on favourable terms. Existing iZettle customers can get a loan repaid based on future card sales. Days you earn more, you also pay a bit more back on your loan. You need a certain history with iZettle to qualify for a loan.

Use SumUp in continental Europe, US and Brazil

iZettle can be used within the UK only. The company says they are working on making it possible for UK vendors to use it elsewhere in Europe, but as of 2017, this features is not available.

By default SumUp does not work abroad either, but the company say they consider opening up for us abroad in countries covered by their operations. If you want to accept cards on a trip overseas, you can contact their customers service providing the exact dates you want to trade.

In Europe, SumUp eligible countries include Austria, Belgium, France, Germany, Ireland, Italy, Netherlands, Poland, Portugal, Spain, Sweden and Switzerland. You can also apply to use SumUp in Brazil and the United States.

In summary: it depends

If you are just interested in being able to take cards and have fairly low sales volume, SumUp’s offer is hard to beat. If you will benefit from the additional features and services iZettle has to offer, that is likely to pay itself back with the slightly higher fees for low to medium volume merchants.