So you are ready to accept credit cards, but you don’t know which mobile-point-of-sale solution to choose? It’s okay, it’s not just you, everyone has a difficult time choosing the right service. For most, it comes down to a price versus quality question.

In this article, we are focusing on what you pay to use Payleven and iZettle in the UK.

Update 2017: Since this article was written, Payleven has stopped taking new customers. iZettle has lowered its best rate to 1% (down from 1.5%). To calculate your transaction rate with iZettle, enter your expected monthly card transaction volume here.

A couple of words about the two mPOS players

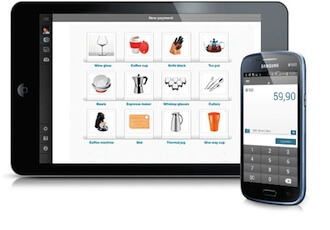

Both feature certified security, great customer interface experience though the App, and useful sales reports and bookkeeping tools for merchants.

The pricing of two solutions have a lot in common too: Their transaction rates start at 2.75% and end at 1.5% (update: iZettle lowered their best rate to 1.0%), they provide the card reader for a certain cost, they require no contract, and they only charge merchants for sales.

Their card readers are priced in the same range: Payleven’s is £59–79 ex VAT, while the iZettle reader is £59 ex VAT (for a limited time – see offer).

Costs: the sliding transaction fee

iZettle first introduced a dynamic pricing scale called “Smart rate” with the transaction fee being gradually reduced with increasing sales volume. For merchants with higher volume, this meant iZettle offered the more attractive solution of the two. In September 2014, though, Payleven introduced its own dynamic pricing structure, replacing the earlier flat pricing at 2.75%. Even though it differs from iZettle’s model as we will see, it is based on the same principle: the more you sell, the lower the transaction costs become.

[table id=1 /]Payleven has three thresholds that merchants need to consider when calculating their monthly revenue: Businesses processing up to £2,500 per month get the usual 2.75% transaction fee. The first threshold for Payleven is £2,501. For iZettle the rate starts to become more favourable from £2000.

Things get interesting when your sales move past this threshold: When processing payments between £2,500 and £5,000, Payleven charges you 2.25%, which further drops to 1.75% for every transaction made above £5,000 and up to £7,000. You get Payleven’s best transaction fee of only 1.5% if you process more than £7,000 per month.

While the iZettle pricing structure is dynamic as well, it is different from what Payleven offers: The transaction fee continuously drops as soon as your monthly processed payments exceed £2,000. Up to that milestone, you get the regular 2.75% rate.

In numbers: rates at different volumes

Actually, if you look at some important milestones, you can see that Payleven seems to offer better rates than iZettle. If you process £3,000 in a month, you get a 2.39% transaction fee from iZettle, which means a total monthly cost of £72. If we double that amount to £6,000 per month, you get a 1.78% rate, which raises the monthly cost to £107.

As for Payleven, for the same £3,000 you get a 2.25% rate, which means your monthly cost will be £67.50. Going further, if we double the amount, we reach another threshold, the 1.75% rate, which means that you will have to pay only £100.50 for that month’s transactions.

The pricing strategy continues to favour Payleven above the £7,500 threshold as well, since you get the 1.5% rate for every transaction, while you get the same rate from iZettle only after you process £12,250 in a month.

If you increase your monthly sales further, you are definitely better off with iZettle. If your monthly sales exceeds £12750, your iZettle rate will dip below 1.50% and go as far down as 1.00% when monthly sales reaches £40,000. Once your sales reaches £10,000 and above, and you are taking a relatively high share of credit cards, iZettle can also be a competitor to traditional processors like WorldPay and SAGE.

However, even at lower monthly volumes you may still benefit from iZettle compared to Payleven. Let us say you are merchant who think you will add up debit and credit card sales to around £2,000-£2,500 per month, you will be better off with iZettle. Payleven’s dynamic pricing will only kick-in at £2,500, while you can start to benefit from reduction to the 2.75% from iZettle in the £2,000-£2,500 range. Similarly, if you think you will gravitate around £4,000-£5,000 in card sales per month, you will be better off with iZettle as your rate would vary between 2.20% and 1.92%, while with Payleven you would stay in the 2.25% bracket.

Which is better? It depends

As we have seen, the fee scales of Payleven and iZettle are relatively similar. For merchants with a quite predictable sales volume, one might come out better than the other as we have seen above.

One could possibly say that Payleven offer potential higher reward, but also slightly higher “risk”: you may get stuck just before reaching the next threshold, and as such the more continuously sliding scale of iZettle could be seen as a “safer” bet.

With both services now offering competitive transaction fees, the final decision might depend on other factors. If accepting American Express is important to you, go with iZettle. Currently only iZettle offers American Express and Union Pay in addition to Visa and MasterCard. Payleven has reduced their deposit time, and merchants will now get their funds within 4 – 7 business days. iZettle claims that it merchants will have money on their account within 3 days in most cases.

On a final note, merchants needs to be aware how the fee is calculated: During the month, both players will charge you the standard 2.75%, so there will be no visible cost savings when the transaction takes place. The actual fee will be calculated at the end of each month when the total sales volume has been established. Both Payleven and iZettle will send you a cash back payment based on the total transaction volume.