The Authorize.net mobile app allows businesses to take payments with their smartphone – no card terminal needed. How convenient, secure and affordable is the service? In this review we dig deeper.

Established in 1996, the company is a fully owned subsidiary of Visa, and has acquired more than 400,000 customers in the US and Canada. In addition to mobile and online payment processing, Authorize.net offers services to retail merchants, as well as processing of cards over the phone.

Payment gateway account, not merchant account

The first thing to be aware is that Authorize.net offers payment gateway accounts, the interface that allows payment processing to happen, but not merchant accounts. A merchant account is a type of bank account that allows business to accept credit card payments.

To use Authorize.net’s mobile payment app you need to register for their payment gateway account, AND have a merchant account. If you already have a merchant account – great. If not, you can sign up with one of their recommended partners, or you can go for a full service payment processor like PayPal – with the pros and cons that entails.

Authorize.net is competitively priced

- Free App

- $99 one time setup fee

- $20 monthly gateway fee*

- $0.10 transaction fee (in addition to merchant account fees, usually 0.39% + $.10 and up)

- $0.25 batch fee

- Optional services: Advanced fraud detection suite at $9.95 per month.

* The gateway fee includes an online gateway account that can be linked to an ecommerce site, if desired.

Cards accepted

Visa, MasterCard, American Express, Discover, Diner’s Club, JCB and Signature Debit Cards.

Which phones and tablets does it work with?

The app was first developed for Apple devises, iPhone, iPad and iPad and iPod touch. The app requires iOS 5.0 later. While it can work with earlier versions of the iPhone, it is optimimized for iPhone 5.

An Android app was added later. It can work on any Android phone and tablet with Android 2.2 or later. It is optimized for Android tablets, 7 inch and 10 inch models.

How does it work?

Register for an Authorize.net Gateway Account with Card not Present functionality.

- Dowload the free app from the Apple App Store or from Google Play for Android devices.

- Login to the App using the same Merchant Interface login details as for the Authorize.net Gateway Account.

- Before you can use the app, you have to authorize it though your Merchant Interface. Go to Account/Settings/Security Settings/Mobile Device Management and click Enable Device.

- You can configure sales tax and enable tips in the settings of the app.

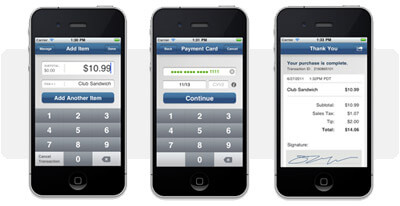

- Add items to the transaction with price and a description, if desired.

- Go to the review order page, where both the seller and the customer can review the order on the screen.

- The seller keys in the card number and card expiry date through a secure encryption platform.

- At the last step the customer will approve the transaction and sign electronically on the smartphone. Receipt can be sent electronically.

Merchants can log into the Merchant Interface online to manage their transactions, configure account settings, view statements, and generate reports. The basic functionality of the interface is free.

How secure is it?

Authorize.net is compliant with the Payment Card Industry Data Security Standard (PCI DSS). Customers should therefore be confident that their card holder data is secure. The card holder data is not saved on the device.

As a fraud protection measure, it is recommended that merchants enable both CCV2 and Address Verification Service (AVS), both optional. If the AVS is activated, the customer will be requested to provide his or her zip code, and this will be checked with the cardholder bank data. Merchants should still make sure they verify the signature of the card holder.

As a further measure to enhance data security, the merchant can add an encrypted swipe card reader. The card can then be swiped instead of keyed in. This card reader is optional, and will have to be purchased separately.

Customer service and satisfaction

Customer support via toll-free telephone, e-mail and online chat Monday through Friday, 5 am to 5 pm Pacific time.

Looking at BBB reports, the most common complaint is chargebacks, meaning that the card holder for some reason disputes the transaction and requests for it to be annulled. Authorize.net will not take responsibility for the chargebacks as long as the card detailed entered were correct.

How do you get started?

Sign-up for an Authorize.Net Card Not Present Gateway accout online. It takes only 10-15 minutes. You will need the company name and contact details, as well as the account owner (individual) name and details. You will also need your account information for billing purposes, and the details of your merchant account if you have one.

Pros

- Relatively low fees.

- No need for a reader/device to accept payments – your phone is enough.

- If you need both an online payment gateway and mobile payment capability, the merchant interface online will serve both.

Cons

- If you do not have a merchant account, you will have to get one in addition to the Authorize.net gateway account.

- Their mobile app lacks an inventory of products/services. The price and product/service, will have to be added for each sale.