What’s the best online payment solution for small businesses? The answer depends on your type of business, sales volume, online payment methods required, and whether you need or have an online store already.

Some platforms make it super-easy to set up if the card processing system is already integrated. Others are purely offering a payment system to connect manually with an outward-facing sales channel – this usually requires technical know-how. In other words, not everyone would be confident with some of the leading solutions.

Compare the best online payment systems UK:

| Provider | Best for | Website |

|---|---|---|

| 1. Square | Breadth of user-friendly, free online payment tools accessible in app or web browser | |

| 2. Worldpay | Trusted payment processing with your own merchant account & custom fees | |

| 3. PayPal | Popular with payers because of Buyer Protection, familiarity & convenience | |

| 4. SumUp | Simplicity & accessibility of payment features with fixed card rate & no monthly fees | |

| 5. Adyen | High-volume businesses needing a custom solution for global customers | |

| 6. Revolut | Low transaction costs and multi-currency accounts for international payments | |

| 7. 2Checkout | International payments and advanced subscription features | |

| 8. Stripe | Advanced, scalable payment flows managed by your own developer |

| Provider | Best for | Website |

|---|---|---|

| 1. Square | Breadth of user-friendly, free online payment tools accessible in app or web browser | |

| 2. Worldpay | Trusted payment processing with your own merchant account & custom fees | |

| 3. PayPal | Popular with payers because of Buyer Protection, familiarity & convenience | |

| 4. SumUp | Simplicity & accessibility of payment features with fixed card rate & no monthly fees | |

| 5. Adyen | High-volume businesses needing a custom solution for global customers | |

| 6. Revolut | Low transaction costs and multi-currency accounts for international payments | |

| 7. 2Checkout | International payments and advanced subscription features | |

| 8. Stripe | Advanced, scalable payment flows managed by your own developer |

First, some basics: To accept online payments, you need a card processor connected to one or more of these sales channels:

An online payment system may offer some or all of these channels. Certain solutions require coding through so-called APIs (Application Programming Interface) to set up the payment system. Others are already connected with user-friendly sales tools – for example, so you can easily send and manage invoice bills without embedding a pay button on invoices.All web stores use a payment gateway, which is an online payment processor connected to a checkout page. But user-friendly online payment solutions already have this set up so you just have to create the shop in a website builder. Lots to consider here – now, let’s go through the different solutions.

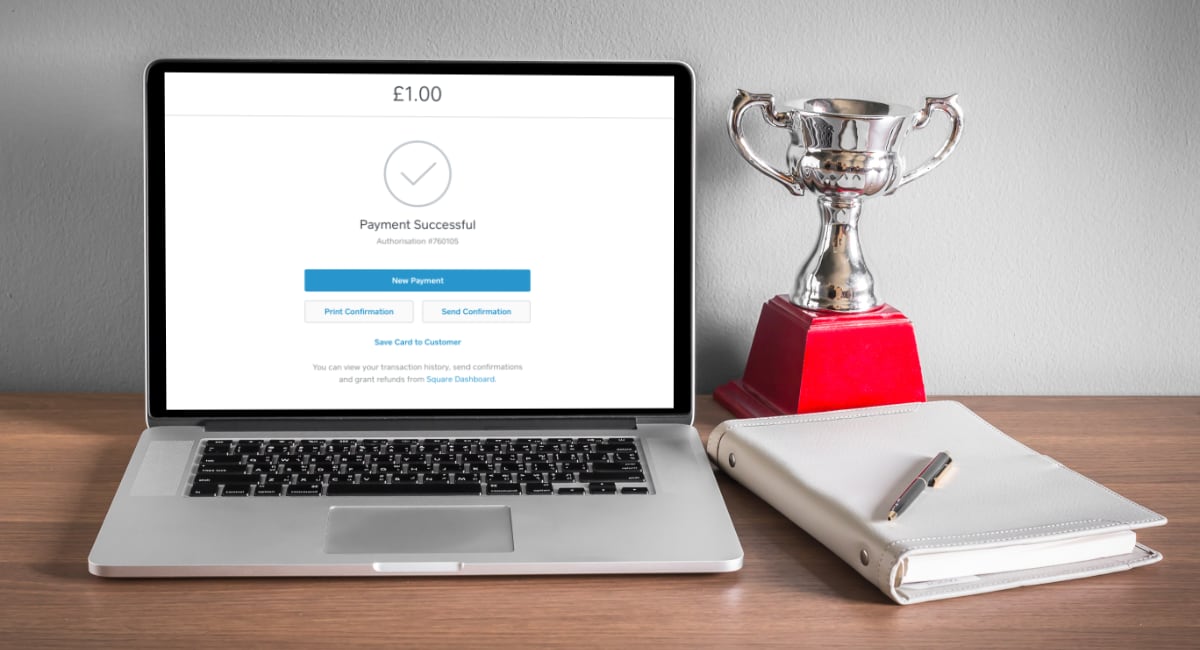

1. Square – easiest, most complete out-of-the-box solution

No other payments platform in the UK has a wider range of free online payment tools than Square. There’s no contractual commitment, no monthly fees (unless you upgrade to a paid online store plan), only pay-as-you-go transaction fees.

Square handles payment processing so there’s no need to install anything to accept payments in your bank account. You just need to create an account via the quick online sign-up form and start using the payment tools available in your Square account.

|

|

|---|---|

| Payment system | Already integrated with Square selling tools. APIs available to connect Square Payments with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-2 working days.Immediately with Instant Transfers (1% extra fee). |

| Fees | Online store, links:European cards: , Non-European cards: Virtual terminal, invoices: No contract, no monthly fees (except for online store plans) |

|

|

|---|---|

| Payment system | Already integrated with Square selling tools. APIs available to connect Square Payments with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-2 working days.Immediately with Instant Transfers (1% extra fee). |

| Fees | Online store, links:European cards: , Non-European cards: Virtual terminal, invoices: No contract, no monthly fees (except for online store plans) |

If most of your payments are from a UK/European debit or credit card, you pay an attractive, fixed online rate of per transaction. Non-European cards incur a fee per transaction. With an annual turnover of at least £250k, you can negotiate lower fees with Square.

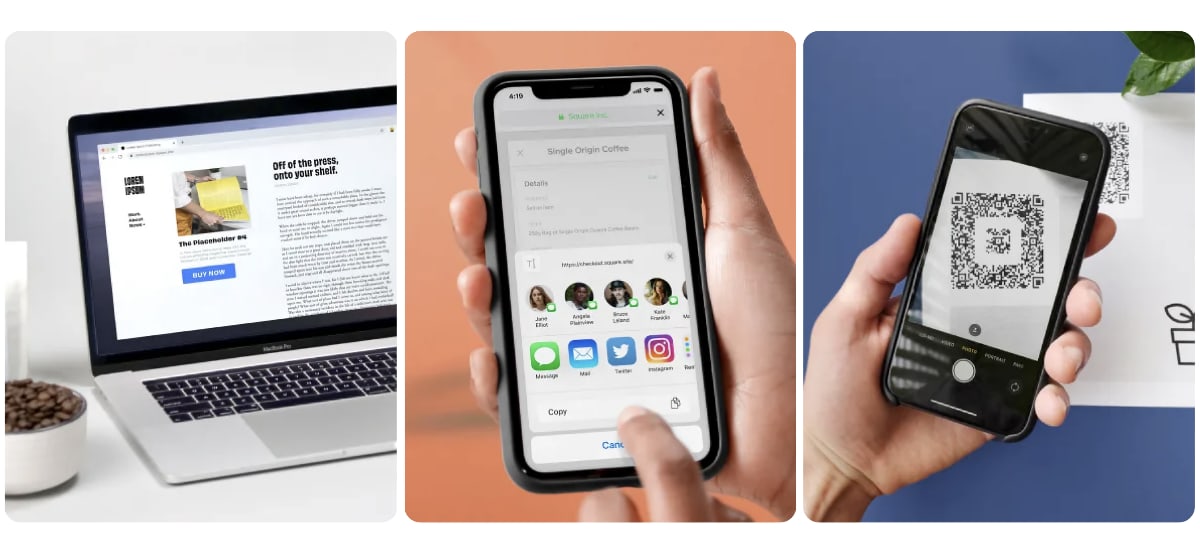

We are impressed with how many features you actually get without a monthly fee. For example, the virtual terminal for over-the-phone payments is more advanced than certain other providers charging for theirs. Online Checkout can be used for sending payment links, printing QR codes for your premises for socially distanced orders and adding pay buttons on an existing website. Square Invoices has its own app for managing all client invoices for bills or estimates.

You can set up an online store for free, but a professional-looking website probably requires a paid online store plan that has more features. An online ordering page for collection or delivery can be set up for free. Online gift cards can also be issued and accepted.

Alternatively, you can integrate Square with many different kinds of partner apps for e.g. accounting and online takeaway platforms. APIs are also available to add Square Payments to a different ecommerce solution.

Pros

Cons

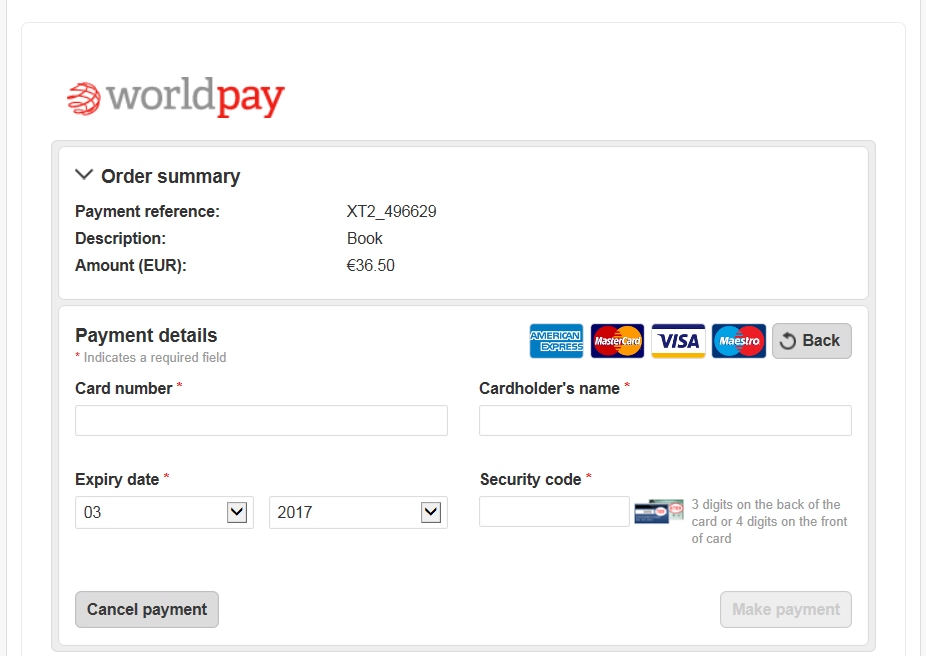

2. Worldpay – solid processor for established merchants

Worldpay has been a trusted online payments provider for decades. In fact, it processes around 40% of all card payments in the UK, making it the leading payment processor in this country.

Signing up requires talking to a Worldpay representative who will give a quote based on your sales volume, type of business and online system required. This is great for those preferring personalised rates but difficult for those uneasy about negotiating transaction fees and a contract for a new business that hasn’t taken off yet.

|

|

|---|---|

| Payment system | Online payment gateway that can be connected with many ecommerce platforms. Certain tools are available from Worldpay without the need to install software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. |

| Fees | Virtual terminal, pay-by-link: £9.95 + VAT/mo + custom ratesOther ecommerce: Custom pricing30-day rolling contract or longer commitment |

|

|

|---|---|

| Payment system | Online payment gateway that can be connected with many ecommerce platforms. Certain tools are available from Worldpay without the need to install software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days. |

| Fees | Virtual terminal, pay-by-link: £9.95 + VAT/mo + custom ratesOther ecommerce: Custom pricing30-day rolling contract or longer commitment |

You can get long-term contracts or rolling, 30-day contracts that can be cancelled any month. Businesses get their own merchant account, which makes payment processing more reliable than, say, Square’s or PayPal’s. Transaction fees are competitive with a consistent online card turnover of at least £2,000 per month. Foreign and premium cards like American Express have the highest rates (e.g. 2.75%), whereas domestic cards typically have the lowest rates (e.g. 0.95%). Some plans include PCI compliance (payment security standard), whereas others require you to set up PCI compliance at a cost.

Worldpay Virtual Terminal can be used for remote payments where the merchant enters card details while talking to the customer on the phone. Worldpay Pay by Link is for embedding unique payment links into an email or digital invoice so the customer can pay on a secure web page. Both can only be used in a web browser, not mobile app.

The online payment gateway can either be a ‘Hosted Pay’ page taking your customers to a standard checkout page outside your website, or an ‘Integrated’ payment page on your website. The latter makes you responsible for your own PCI compliance, but then you have full control over the checkout experience. You can, for example, enable the option for customers to save card details (card on file), set up recurring payments and accept different currencies. There are many ways to customise online payments with Worldpay, but it may be a little complicated to do.

Pros

Cons

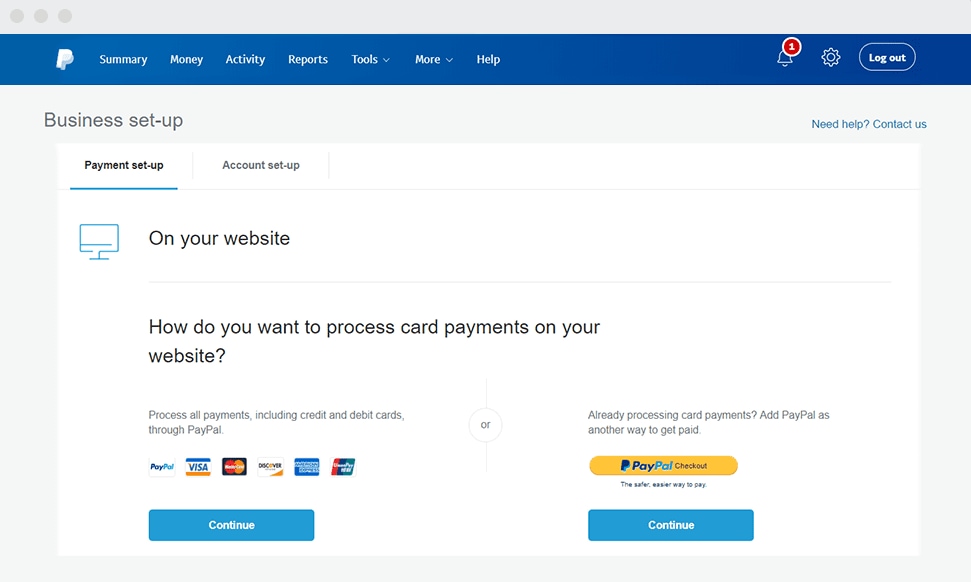

3. PayPal – accessible tools with online account

As an early innovator in online payments, PayPal is well-known among businesses and consumers alike. The familiarity of the brand and Buyer Protection mean that your customers are likely going to feel safe paying through PayPal – but it is far from the cheapest payment system for most businesses.

It is easy and free to sign up online for a PayPal Business account, which you’ll need for any of the payment tools. It is an e-money account based online, meaning it is not a bank account or traditional merchant account such as Worldpay’s.

Money received through PayPal will go straight into your online account. If you need to have the money in a bank account, you have to manually withdraw it to the bank account connected to the PayPal account. This can take a few working days or hours, depending on your bank.

|

|

|---|---|

| Payment system | Already integrated with payment tools. Codes available to integrate pay buttons or online gateway on your website. |

| Selling tools |

|

| Payouts | Immediate in online account.Manual transfers to bank account take 0-2 working days. |

| Fees | Standard transactions: 2.9% + 30pNon-UK cards: 0.5%-2% cross-border fee, 2.5% currency conversion feeNo contract, no monthly fees (except for Virtual Terminal & advanced checkout plan) |

|

|

|---|---|

| Payment system | Already integrated with payment tools. Codes available to integrate pay buttons or online gateway on your website. |

| Selling tools |

|

| Payouts | Immediate in online account.Manual transfers to bank account take 0-2 working days. |

| Fees | Standard transactions: 2.9% + 30pNon-UK cards: 0.5%-2% cross-border fee, 2.5% currency conversion feeNo contract, no monthly fees (except for Virtual Terminal & advanced checkout plan) |

Email invoices, QR codes, payment links, buy buttons and a standard integrated checkout on your website (PayPal Checkout) have no monthly fees. The payment tools with a monthly fee of £20 include the virtual terminal and advanced checkout solution called Web Payments Pro. There’s no contractual commitment for any of these features, so they can be cancelled any time.

The standard transaction fee for invoicing, payment links, pay buttons and online checkout is 2.9% + 30p. An additional cross-border fee of 0.5%-2% applies to non-UK cards, as does a currency conversion fee of 2.5% where applicable. Merchants can apply for blended fees that adjust to the type of card being used, and those with an online turnover above £50k monthly can also get better fees. Other general fees apply, such as £14 per chargeback.

Although non-UK card payments are expensive, a main advantage of PayPal is its ability to accept many currencies. Moreover, adding PayPal as an optional payment method to your online checkout can secure more transactions because payers trust it and already have a PayPal account that’s convenient for them to use. Many sellers, however, have had issues with account holds and poor customer support. We don’t recommend PayPal for their fees or taking the seller’s defence in customer disputes where Buyer Protection takes priority, but it is undoubtedly an asset to offer PayPal for customers who prefer it.

Pros

Cons

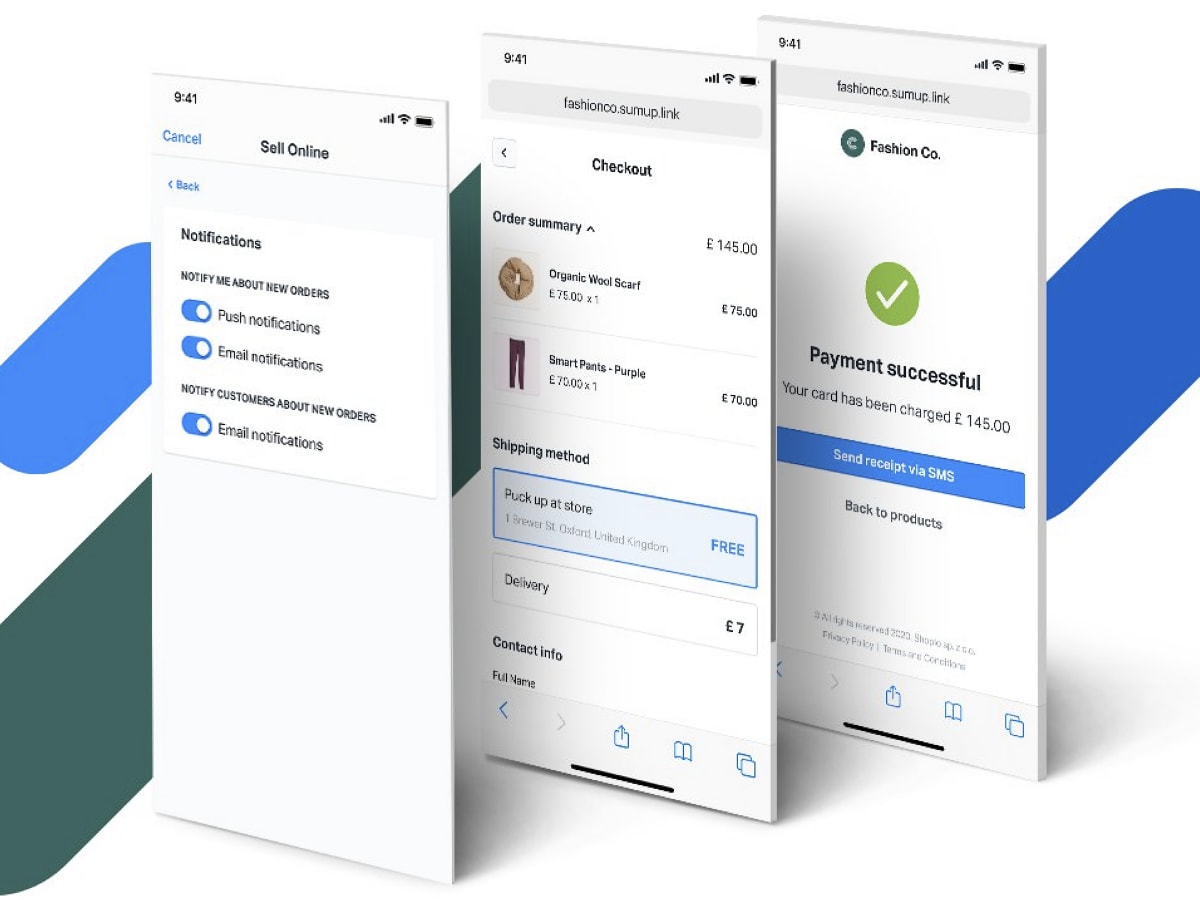

4. SumUp – simple and convenient features from app

SumUp has added lots of new online payment features in the past year. This is a payments provider primarily intended for face-to-face merchants (see SumUp’s inexpensive card readers), but merchants who can buy a card reader can accept transactions online as much as they like.

The online sign-up form is very quick to fill in, after which it takes a few days for SumUp to verify and connect your bank account. Payouts automatically go into this bank account within 1-3 working days. With the free SumUp Mastercard activated, transactions can settle in an online SumUp account the next day, even on weekends.

|

|

|---|---|

| Payment system | Already integrated with SumUp selling tools. APIs available to connect SumUp with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days.Day after with SumUp Card (online account). |

| Fees | Online store, links, invoices: Virtual terminal: No contract, no monthly fees |

|

|

|---|---|

| Payment system | Already integrated with SumUp selling tools. APIs available to connect SumUp with external ecommerce software. |

| Selling tools |

|

| Payouts | In bank account within 1-3 working days.Day after with SumUp Card (online account). |

| Fees | Online store, links, invoices: Virtual terminal: No contract, no monthly fees |

The pay-as-you-go fee of applies to transactions via links, QR code, e-gift cards, invoices and ecommerce. It costs for all virtual terminal transactions. None of the features have ongoing monthly charges or contractual commitment.The online payment features can all be accessed in the SumUp App from an iPhone, iPad or Android device. This includes the Online Store Starter, an extremely basic online store that can be created in minutes from your app. You can then link to it on social media or elsewhere online and accept orders for delivery or collection.

Through the point of sale (POS) checkout in the app, you can also send payment links for specific transactions through SMS or messaging, or generate QR codes for customers to scan with their phone camera. You can send email invoices, or key in payments through the simple Virtual Terminal in the app or web browser. A gift card page can be shared online so people can buy digital gift cards to spend in your store.

A great thing about SumUp is how extremely easy it is to use the features, but also the easy access to online tools through an app. The lack of monthly fees and the competitive fixed rates make this attractive to casual or micro-merchants, but there’s no straightforward way to connect SumUp’s online payment system to a professional ecommerce website.

Pros

Cons

5. Adyen – excellent features for high-volume businesses

Adyen is a global online payments system used by many popular companies like Spotify, Booking.com and Etsy. It is geared towards high-volume businesses making at least £1.5-£2 million yearly who’d consider it as their one and only payment system (including till sales, if that’s required). You can take pretty much any kind of payments online with Adyen, in any currency.

To be frank, you need to make at least £20k per month in online sales to make this worth the cost, because Adyen requires a minimum monthly transaction fees payment of €100/US$120. While there’s no setup fee, you have to pay Adyen a minimum of €500 as a deposit to sign up, which is returned when you close the account.

|

|

|---|---|

| Payment system | Card processing integrated with payment tools requiring coding and/or customisations. |

| Selling tools |

|

| Payouts | Batch payouts every day, twice a week, weekly, every 2 weeks, monthly or yearly. |

| Fees | Transactions: Variable fees depending on payment method (min. €100/mo required)Account deposit required: €500No contract, no monthly fees |

|

|

|---|---|

| Payment system | Card processing integrated with payment tools requiring coding and/or customisations. |

| Selling tools |

|

| Payouts | Batch payouts every day, twice a week, weekly, every 2 weeks, monthly or yearly. |

| Fees | Transactions: Variable fees depending on payment method (min. €100/mo required)Account deposit required: €500No contract, no monthly fees |

Transaction fees are typically between 0.2%-3% depending on the card being used (domestic debit cards are cheapest while premium cards from abroad cost more). There’s also a 10p gateway fee per transaction. Apart from a full choice of debit and credit cards, you can accept many alternative payment methods such as PayPal, Klarna and Amazon Pay.

With Adyen, you cannot easily set up payments without some degree of technical know-how. After signing up, you go through integration steps and customisation options. For example, an Adyen online checkout has to be installed manually on your website. The payment flow, layout, language, taxes, receipts and more are tailored by you, whether that’s for an online store checkout or the many different uses you can have for Adyen’s payment links. A payout schedule can be set via APIs, which obviously requires coding.

You can accept recurring payments like subscriptions, and gift cards if integrated with an external gift card provider. Although pay buttons can be added to messages, websites, social media and invoices, Adyen doesn’t have a way to manage email invoices or accept virtual terminal payments.

Overall, Adyen is excellent for custom solutions where you want a lot of influence in the style and payment flow of online transactions. It’s best managed with a developer on hand, but that also makes it highly scalable.

Pros

Cons

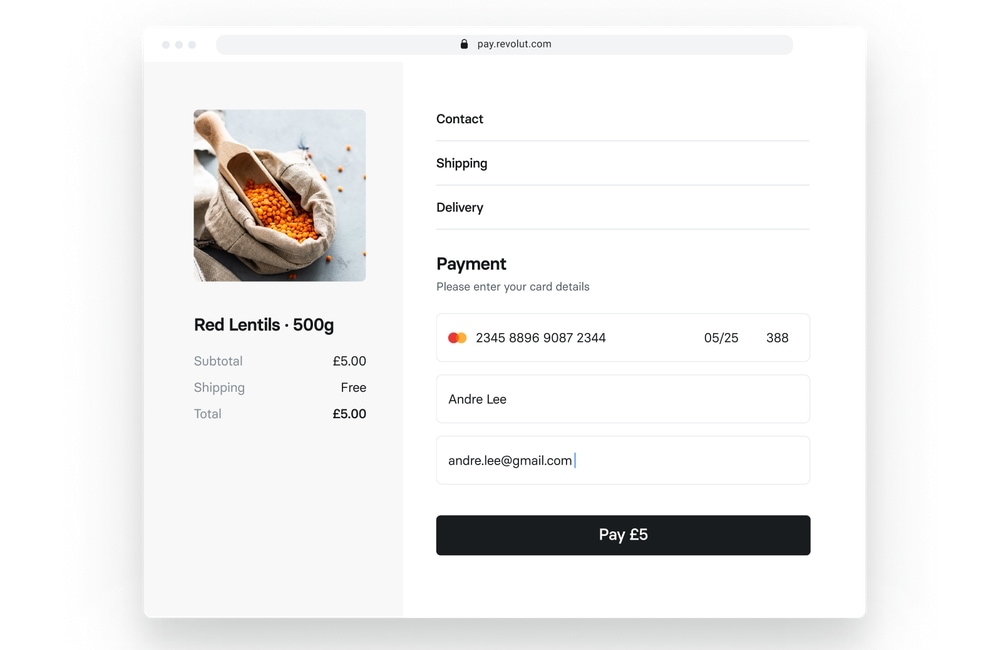

6. Revolut – free transactions with account subscription

Revolut Business accounts now have the option to accept payments online: this is called Revolut Online Payments and includes payment links, QR code payments and an online gateway.

With a range of free and paid business accounts for either companies or freelancers, the first step is to sign up for one of these plans, which includes a Prepaid Mastercard. You can then apply for online payments through the account – it may take a couple of working days to process this application.

|

|

|---|---|

| Payment system | Payment links ready to use. Online gateway plugin compatible with WooCommerce, Magento and PrestaShop, APIs available for other website platforms. |

| Selling tools |

|

| Payouts | In Revolut account within 1 working day. |

| Fees | UK/EEA consumer cards: Free within monthly thresholds (set by Revolut Business plan), 1.3% fee beyond thresholdAll other cards: 2.8% per transaction |

|

|

|---|---|

| Payment system | Payment links ready to use. Online gateway plugin compatible with WooCommerce, Magento and PrestaShop, APIs available for other website platforms. |

| Selling tools |

|

| Payouts | In Revolut account within 1 working day. |

| Fees | UK/EEA consumer cards: Free within monthly thresholds (set by Revolut Business plan), 1.3% fee beyond thresholdAll other cards: 2.8% per transaction |

On the free Business account plans, you pay 1.3% for all consumer debit or credit card transactions if the card was issued in the UK or EEA. Paid plans, on the other hand, include a monthly limit of free transactions for these cards. All other Mastercard and Visa cards incur a 2.8% fee (no other card brands are accepted).

| Companies | Freelancers |

|---|---|

| Free plan Free Online payments* 1.3% |

Free plan Free Online payments* 1.3% |

| Grow plan £25/month Online payments* £2,000 included |

Professional plan £7/month Online payments* £500 included |

| Scale plan £100/month Online payments* £9,000 included |

Ultimate plan £25/month Online payments* £2,000 included |

*UK/EEA-issued consumer card transactions only. Other cards always cost 2.8%.

| Companies | Freelancers |

|---|---|

| Free plan Free Online payments* 1.3% |

Free plan Free Online payments* 1.3% |

| Grow plan £25/month Online payments* £2,000 included |

Professional plan £7/month Online payments* £500 included |

| Scale plan £100/month Online payments* £9,000 included |

Ultimate plan £25/month Online payments* £2,000 included |

*UK/EEA-issued consumer card transactions only. Other cards always cost 2.8%.

You can send payment links directly from the Revolut app via text message, email or social app, whereafter the customer just needs to click on the link, enter card details and finalise the transaction. QR codes can also be generated on the screen for touch-free scanning, if the customer prefers this.

A Revolut checkout can be deployed in your existing online store through a quick installation of a plugin. However, this plugin is currently only available for WooCommerce, PrestaShop and Magento.

If you’re using another website platform and have the technical skill, you can implement the Revolut payment gateway there through APIs. Web developers can also customise the checkout experience thanks to these APIs.Revolut’s multi-currency accounts are great for those receiving payments across borders. You can accept 14 different currencies online, and payments can then go directly to the matching currency account to avoid conversion fees.

Pros

Cons

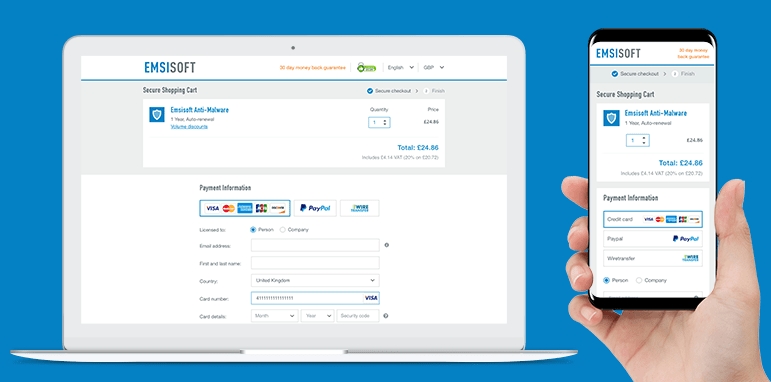

7. 2Checkout – for global businesses and complex solutions

2Checkout (recently acquired by Verifone) was one of the first to offer online payments internationally. It works in 180+ countries, which opens up business to anywhere across the globe. The platform accepts many payment methods in over 120 different currencies and has the option to accept payouts in different currencies (normally, you can only settle transactions in your local currency).

Creating a 2Checkout account is done easily online with no setup fee. There are three main plans with no monthly fees: 2SELL with a 3.5% + £0.25 transaction fee, 2SUBSCRIBE with a 4.5% + £0.35 transaction fee, and 2MONETIZE with a 6% + £0.45 fee for any card payments.

|

|

|---|---|

| Payment system | Needs to be connected with ecommerce software via integration steps or APIs. |

| Selling tools |

|

| Payouts | Weekly, every-2-weeks or monthly payouts in bank account. |

| Fees | Transactions: 3.5%-6% + £0.25-£0.45 depending on planCurrency conversion: 2%-3%No contract, no monthly fees |

|

|

|---|---|

| Payment system | Needs to be connected with ecommerce software via integration steps or APIs. |

| Selling tools |

|

| Payouts | Weekly, every-2-weeks or monthly payouts in bank account. |

| Fees | Transactions: 3.5%-6% + £0.25-£0.45 depending on planCurrency conversion: 2%-3%No contract, no monthly fees |

In order to receive payouts, you need to have at least £50 in your 2Checkout account on the two former plans or £100 on the 2MONETIZE plan. This “deposit” can make it a bit confusing to check how much you’ve been charged in transaction fees.

2Checkout takes a modular approach to features. This means you can add bundles of features related to subscriptions (recurring billing), global payments, tax and financial services, digital commerce and more. You can integrate the online gateway with over 120 ecommerce platforms for a custom checkout flow and access more tools on the two higher plans.

The subscription payment system is especially advanced, so 2Checkout is particularly useful for software-as-a-service (SaaS) businesses or other membership payment models.

2Checkout’s system is built for high-growth and large online businesses, but fees are pretty steep for card transactions. You’ll need to really benefit from the global sales tools and optimisations that the platform excels in to justify the charges.

Pros

Cons

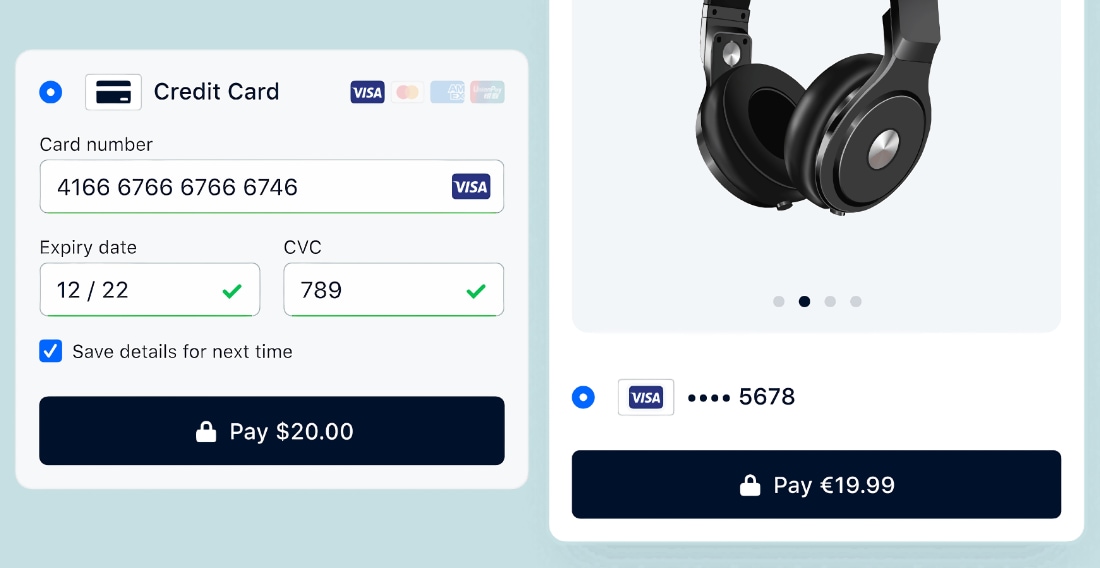

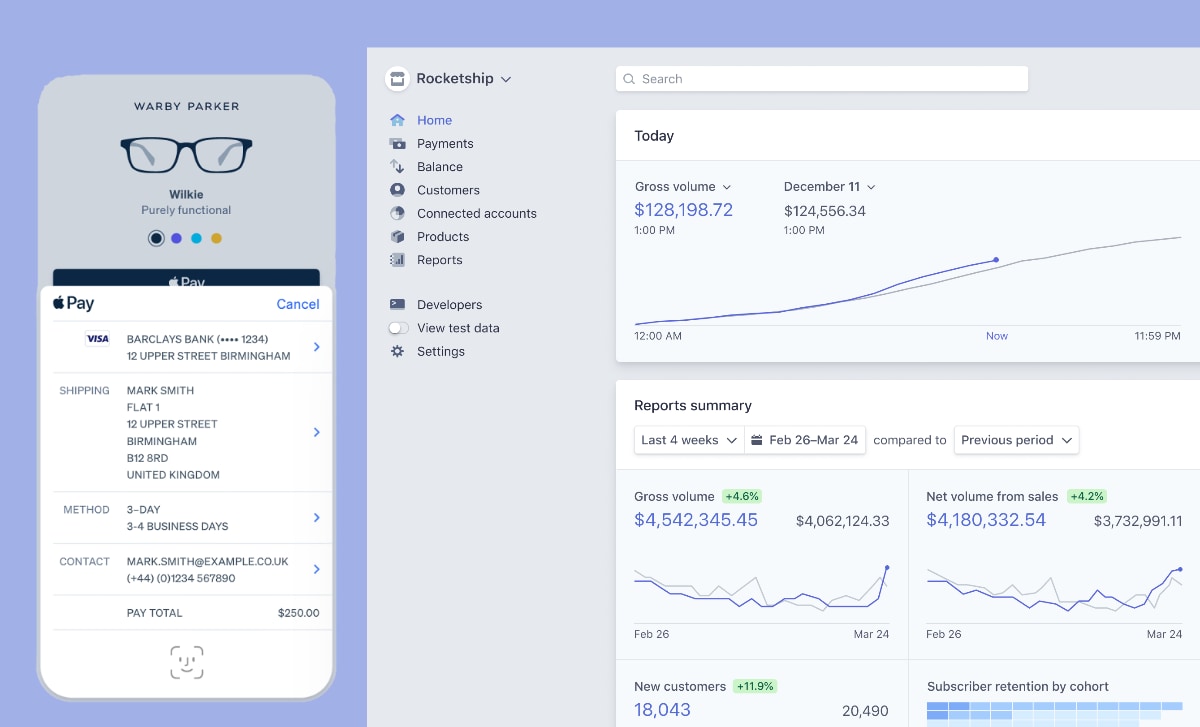

8. Stripe – developer-friendly tools for online payments

Stripe is a big, international payments platform that’s popular among startups and high-growth businesses, small and large. Unless you’re connecting an all-in-one website builder with a Stripe checkout (which is easy in many cases), the platform is mainly geared towards internet businesses needing a custom payment solution.

A Stripe account is easily created online without setup fees or a contract. If you’re doing this as a step to connect e.g. Squarespace or BigCommerce with Stripe, you don’t need coding skills to start receiving payments. Most other features require development expertise, as Stripe provides extensive API documentation to help you create a tailored payment system for your online business.

|

|

|---|---|

| Payment system | Integrates easily with many ecommerce platforms. APIs available to create custom payment flows for your business model. |

| Selling tools |

|

| Payouts | In bank account within 7 working days. |

| Fees | Transactions:European cards: 1.4% + 20p, Non-European cards: 2.9% + 20pCurrency conversion: 2%No contract, no monthly fees |

|

|

|---|---|

| Payment system | Integrates easily with many ecommerce platforms. APIs available to create custom payment flows for your business model. |

| Selling tools |

|

| Payouts | In bank account within 7 working days. |

| Fees | Transactions:European cards: 1.4% + 20p, Non-European cards: 2.9% + 20pCurrency conversion: 2%No contract, no monthly fees |

Types of payment solutions created in Stripe include subscriptions, custom checkout flows for websites and apps, and invoices. A virtual terminal is available in the Stripe account for occasional over-the-phone payments. The customisation options make Stripe ideal for marketplace platforms, membership-based businesses and SaaS products, but cross-border retailers can also benefit from the wide choice of currencies accepted. With ‘Integrated’ Stripe, you’re only charged 1.4% + 20p for transactions paid with cards issued in Europe, and 2.9% + 20p for non-European cards. An additional 2% currency conversion fee is added to payments in a non-GBP currency. Recurring payments only incur a 0.5% fee per transaction. ‘Customized’ Stripe users with a large sales volume and/or unique business models have other fees.

Stripe’s payment system is a scalable solution with good sales reports, fraud prevention tools and step-by-step guides for shaping your online payment system. Just beware it is not an easy thing to set up – unless you’re a developer.

Pros

Cons

Which is best for you?

If you don’t want to hire a developer or pay for a custom ecommerce setup, it is best to choose an online payment platform that has out-of-the-box tools with payment processing already integrated.

The most extensive one like this is Square, while SumUp includes easy payment tools intended for merchants using card readers too. Revolut offers simple payment links, but a developer is required in some cases for the online gateway.

If you’re just looking for an online store solution, it might be best to look for the website builder you want and see which payment systems work with that. For example, Shopify is popular with online retailers – it has its own payment system, but Amazon Pay and other payment methods are available too.

Many all-in-one ecommerce platforms can connect with several payment gateways including some of the above.

Learn more:

Best all-in-one ecommerce platforms in the UK

Bigger businesses would be better off with a provider that can lower transaction rates for a high sales volume, like Worldpay and Adyen. Small or seasonal businesses can benefit from a lack of monthly fee, reasonable fixed rates and no commitment offered by Square and SumUp.

Adyen, 2Checkout and Stripe are geared towards multiple currencies and complex solutions, but you may need technical expertise to use these systems.

PayPal comes with an online business account and lots of accessible online sales tools, but can be very expensive for low sales volumes. Revolut Business account has lower fees – but fewer tools – for online payments.

If you know which payment tools you need, have a look at these guides: