See also: Best Payleven alternatives in the UK

- Highs: Good customer support. Rates go down with increased use. Over the phone payment option.

- Lows: Printers are extra. App functionality is good, but not the best available.

- Buy if: You want a contactless reader (though you’ll get faster processing with iZettle).

Mobile point of sale (mPOS) solutions are becoming more mainstream in the UK market. Payleven was the first company to introduce a chip and PIN card reader to the UK, and one of the better options for a small business to take payments over the phone.

So what exactly is Payleven chip and PIN solution?

In simple terms, Payleven allows businesses and private individuals to use iOS or Android smartphones or tablets to accept card payments for goods and services. The process is straightforward and fast; once you have registered with Payleven online or over the phone and downloaded the free app, the company will send you a card reader.

The chip and PIN reader costs £59 (excluding VAT) for the Classic model and £79 for the Plus model. The main difference between them is that the newer Plus model also supports contactless payments. Given the small price difference, it is the better choice of the two.

This video outlines the basics of taking payments and getting started with the reader.

When you have gotten the card reader, the next step is to pair the card reader to your device, which is in itself an easy process that only takes a couple of minutes. Payleven’s mPOS system works wirelessly. The card reader connects to your device using Bluetooth, and then your device connects to the internet via WiFi or 3G and Payleven’s servers complete the transaction.

Once you have paired the reader and device you are ready to go and it is as simple as entering the amount on your device, inserting the card into the reader and asking the customer to enter the correct PIN number.

That’s all there is to it. If the customer wants a receipt, this can be sent via email or printed using a Bixolon thermal printer, which is compatible with the chip and PIN card reader and can be ordered at the same time as when you sign up for the reader.

Payleven’s “Classic” card reader.

What cards does it take and what are the transaction rates?

The types of cards that are currently accepted are Visa, V Pay, MasterCard, Maestro and American Express. This makes Payleven almost on par with competitor iZettle, which also accepts JCB cards. Payleven has indicated that more cards will be accepted in the future but to date is not specific about which ones and in what timescale. However, most merchants would be satisfied with the range of debit and credit card accepted.

As is the case with some of Payleven’s competitors, there are no monthly fees, the app is available for download for free and the current fee starts at 2.75% of the transaction value, and goes as low as 1.5% for high volume businesses (note that payments over the telephone is charged at 2.95%).

Transactions over £2,500 per month and lower than £5,000 will result in transaction fees of 2.25%. Merchants processing more than £5,000 per month, but less than £7,500 per month will pay 1.75%. The lowest Payleven rate of 1.5% is reached when processing over £7,500 per month.

The way the sliding fee scale works is that transactions will first be charged 2.75%. Then, based on the actual volume for the month any cost savings will be paid back to the customer the following month.

iZettle also has a sliding fee scale, which is slightly different from Payleven’s (also read: Sliding fee scales of Payleven and iZettle — How do they compare?). Businesses with one or more months reaching £7,500 in transactions will benefit from Payleven as the lowest fee of 1.5% is reached at this threshold. With iZettle merchants have to reach £13,000 before the lowest rate of 1.5% is offered.

For a comparison of the top three mobile point of service systems, you can also examine this comparison review of iZettle, Payleven and SumUp. Alternatively, as signing up is free and does not require a commitment or monthly fee, this would be one way to see in more detail if it is suitable for your business.

Over the phone payments at a fair rate and no monthly fee

In addition to the mobile app based card terminal, Payleven offers a virtual terminal for over the phone payments. The process is straight forward: log into your online Payleven dashboard, and follow the step by step instruction for entering of the card data with CCV2 security code.

Over the phone payment are charged at 2.95% regardless of volume. As opposed to virtually all its competitors, there are no monthly fees or monthly minimums. To get started you would need to sign up for a Payleven account and buy one of the two card readers to take card payments in person (at present, it is not possible to sign up for a virtual terminal only).

The maximum charge amount for over the phone payments is £1000.

Extra features: product library and accounting

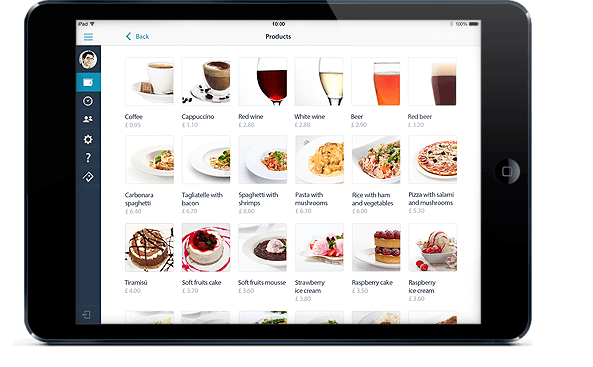

Payleven’s chip and PIN solution gives you a full range of other options too including the ability to enter pictures, prices and descriptions of your products and services.

You can also set up a multi-account where each member of staff has their own chip and PIN reader that is linked to the same bank account. Customer receipts can be sent by email or printed using a mobile printer. It used to be possible to enter a tip using Payleven, but this function was disabled in August 2014 until further notice.

Opening up for use abroad

In principle Payleven can only be used in the country it is registered in. The card reader communicates the location service function on the smartphone or tablet, and if the location service shows that the device is abroad, it will not be able to accept cards.

From November 2014, however, Payleven opened up for use abroad in approved cases. Customers who for example travel for a trade show abroad, can contact Payleven customer service ahead of time, and have the device activated for use abroad.

Customer service – online FAQ, live chat and telephone support

Payleven has a comprehensive list of FAQs online, as a well of a troubleshooting guide and manual. Emails are normally answered within 24 hours, and from Monday to Saturday from 9 am to 6 pm there is a live online chat service and customer support staff available on the phone. The customer service team of Payleven is based in the London head office, working closely with the sales and technical teams.

Replacement terminals are normally shipped out the same day or the next day.

Big expansion plans

Payleven was established in 2012 by a team with diverse experience in payment and financial services. The company has headquarters in London and Berlin and is backed by several venture capital companies including Rocket Internet, the US-based venture capital firm New Enterprise Associates, ru-Net, Holtzbrinck Ventures, and B Cinque.

In addition to the UK, Payleven’s chip and PIN system is available in Austria, Brazil, Belgium, Germany, Poland, the Netherlands, Italy, Ireland, Spain and France.