Need to take payments over the phone, but not sure which virtual terminal to choose? Quite a few payment providers in the UK offer virtual terminals, but only few are truly good value for a small business.

Compared to card machine payments, manually typing card details is more expensive because there’s a greater risk for the card company to accept a card that is not physically read in a terminal.

There is, however, a lot of variation in costs between phone payment terminals. Some providers require a monthly fee, formal PCI-DSS documentation and fees per transaction. Others only require the transaction fee, completely bypassing a traditional contract and subscription charges.

What is a virtual terminal?

- Web page for entering card details securely to accept a payment from a person who is not present.

- Does not read payment cards in a card machine – instead, credit card processing is done through an internet browser.

- Commonly used for mail orders and over-the-phone payments.

So which is the right one to choose? Our virtual terminal comparison gives you an overview.

Best virtual terminals in the UK:

| Provider | Costs | Rating | Website |

|---|---|---|---|

Square |

£0/mo card fee | [star rating=”4.5″ numeric=”no”]Best for range of free features | |

Worldpay |

£9.95 + VAT/moCustom card fees | [star rating=”4″ numeric=”no”]Best for high-volume payments | |

Takepayments |

Monthly or annual feeCustom card rates | [star rating=”3.9″ numeric=”no”]Tailored fees, 12-month contracts | |

PayPal |

£20/mo2.9% + 30p standard card fee | [star rating=”3.5″ numeric=”no”]Connected to other PayPal tools | |

SumUp |

£0/mo card fee | [star rating=”3.5″ numeric=”no”]Access in both app and browser |

| Who | Cost | Link |

|---|---|---|

| Square | No monthly fee, card rate | |

| Worldpay | £9.95 + VAT/mo, custom card fees | |

| Takepayments | Monthly or annual fee, custom card rates | |

| PayPal | £20/mo, 2.9% + 30p standard card fee | |

| SumUp | No monthly fee, card fee |

If you’re looking for no commitment, quick registration and no monthly fees, Square is your best solution. The only thing you pay is a fixed transaction fee per Virtual Terminal payment.

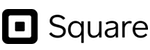

Square Virtual Terminal is a very versatile solution without ongoing costs. Photo: Square

You can go many months without using the terminal, without being charged anything, and it will still be available as a complimentary feature in your Square account.

Square Virtual Terminal accepts Visa, Visa Electron, V Pay, Mastercard, Maestro and American Express.

The virtual payment terminal page is straightforward – enter the card details, amount to be paid and a short note that will be shown in your sales reports (i.e. not for personal details), or itemise the bill with products from your library (or new custom items), taxes, discounts and variants.

Pricing

Monthly cost: Free

Transaction fee: for all cards

PCI compliance: No fee

If you’ve saved a customer’s card details in the system, you can pick that for the payment, or start a recurring payment if charging for a subscription or ongoing service. It is also possible to record the payment in cash, gift card or other tenders, and split the transaction into different payment methods.

Square really has lowered the threshold for getting started with payments, whether it’s for the point of sale, invoicing, ecommerce or in this case a virtual terminal. With a Square account, you can take payments in any of these ways for a fixed percentage rate. There is no requirement to submit PCI documentation with Square, but they do expect you to follow general safety check recommendations in line with PCI regulations.

Best for: Small, new or seasonal businesses needing an easy, not-committing option for remote payments.

As the biggest payment processor in the UK, Worldpay offers everything from card machines to online payments, including virtual terminals. Transaction rates are shaped around your card turnover, business area and card types accepted.

Worldpay Virtual Terminal allows you to add a billing address.

Precise card rates are given by Worldpay when you contact them, but one thing is sure: the Virtual Terminal, on its own, has a fixed monthly fee of £9.95 + VAT. You pay for transactions on top of the monthly cost, and the plan can be cancelled any time with 30 days’ notice.

Worldpay has a broad range of features for remote payments, including recurring payments and pay-by-link where customers can pay via an email link. If you want a payment gateway and pay-by-links together with the virtual terminal, it costs £19.95 + VAT per month.

Transaction fees can be negotiated to comprise of a fixed amount like 10p or 20p + a percentage based on the card type. Debit cards are cheaper (from 0.5%) than credit cards (from 1.4%), and foreign, corporate and premium cards like American Express cost even more (from 1.9%). With no transaction history, you may just get a fixed general rate like 1.75%.

Pricing

Monthly cost: £9.95 + VAT

Transaction fee: Depends on plan, card type & turnover, higher for premium & foreign cards

PCI compliance: Additional costs apply

Visa, Visa Electron, Mastercard, Maestro, American Express and Diners Club are accepted through the Worldpay virtual terminal, but it is possible they allow other card brands with an extra agreement.

Some features – such as advanced reporting – may incur extra fees, and the monthly costs would not be suitable for businesses who only use the virtual terminal occasionally. Customer service is available over phone and email 24/7.

Best for: Businesses with a relatively stable monthly turnover of over £2k monthly, accepting mainly UK-issued debit cards.

Takepayments (previously Payzone) is a popular merchant service provider best known for its card machines. Their virtual terminal solution requires a 12-month contract, but then fees will be tailored to your business.

You can choose between an ongoing monthly or annual fee which may include a certain number of qualifying transactions, beyond which you pay an agreed rate per transaction.

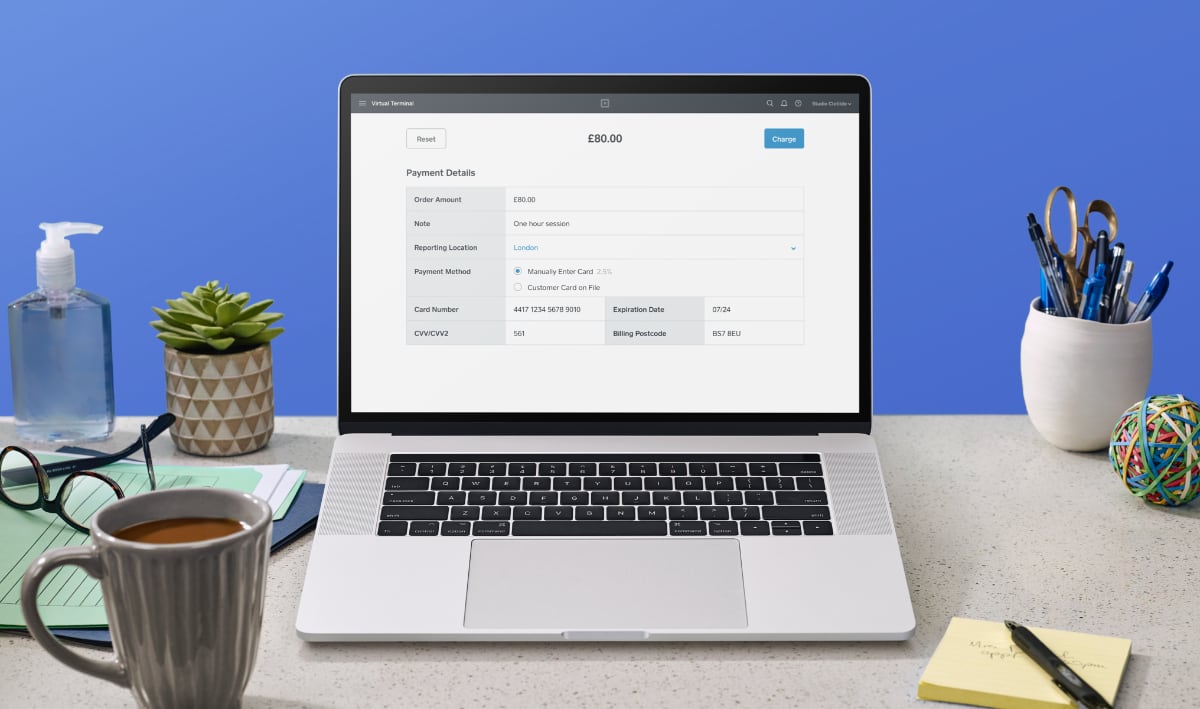

Takepayments Virtual Terminal has a full range of features accessed from a browser.

There is no setup fee with Takepayments, but you do need need to speak with a sales rep on the phone to sign up. A merchant account from Barclaycard or Elavon will be created after agreeing to the quote and contract terms.

A termination fee applies if you do not give at least 60 days’ exit notice. There are also fees for chargebacks (£9), refunds (30p) and PCI-DSS compliance (£15 per month through Barclaycard).

With Takepayments, transaction fees vary between card types, but rates are typically lower than 1% for domestic Visa and Mastercard payments and higher for corporate, premium or foreign cards. Exact fees are only disclosed when you start an application process with the company.

Pricing

Ongoing fee: Custom monthly or annual fee

Transaction fees: Determined at sign-up

PCI compliance: £15/month

The virtual terminal is accessed in a web browser, where payment links are also available. You can itemise transactions for a detailed receipt, and fill in lots of additional information like shipping and customer details. It’s possible to accept different currencies as well.

Takepayments accepts Visa, Mastercard, Maestro and American Express, and transactions settle in your bank account the following working day. Customer support is available every day of the week during working hours.

Best for: Good range of features, next-day payouts and fees tailored for your business.

PayPal is a popular choice for small business, partly because it is so well-known. The virtual terminal itself is effective and highly secure, but PayPal makes it your responsibility to set up PCI compliance, which can be costly if you require assistance.

PayPal Virtual Terminal accepts Visa, Mastercard and Maestro, and transactions settle in your PayPal account within minutes. Customer service is only available during working hours in the UK.

PayPal’s virtual terminal is simple to use, but costs are a little complicated.

To cut to the chase, the costs of their virtual terminal are some of the highest for small businesses. Firstly, there’s a £20 (no VAT applicable) monthly fee for having the virtual terminal in the first place.

As standard, virtual terminal payments cost 2.9% + 30p of the transaction amount. Alternatively, you can apply to be on a Blended pricing plan where transactions cost 1.2% + 30p, or Interchange Plus plan where transactions cost the interchange rate + 1.2% + 30p.

Interchange fees range between 0.2%-2% according to the type of card accepted. For example, a UK-issued, personal Visa Debit card will have the lowest fee, while non-UK, premium or corporate cards have the highest interchange rates.

There is no cross-border charge applied for the Interchange Plus pricing structure, but it is applied to the Standard and Blended rates.

A currency conversion fee of 2.5% on top of the base exchange rate is applied on all plans if the payer’s account is in a non-GBP currency.

Additional fees apply in certain cases, e.g. for “card account verification” or “uncaptured” payments.

Pricing

Monthly fee: £20

Transaction fees:Standard: 2.9% + 30pBlended: 1.2% + 30pInterchange Plus: Interchange % + 1.2% + 30p

Fees for foreign cards:Cross-border: 0.5%-2% (Standard & Blended)Currency conversion: 2.5% (any plan)

PCI compliance: Costs apply

Tired of reading about PayPal fees? Maybe this virtual terminal isn’t for you. However, the platform does offer a broad range of online payment features such as recurring payments and a PayPal checkout on your website. If you’d like to have all this in one place, you may prefer PayPal.

To sign up, you submit an online form followed by a phone call with PayPal to discuss your requirements.

Best for: Online businesses using PayPal services regularly and with primarily UK-based customers.

SumUp is mostly known for its low-cost card readers. They don’t advertise its Virtual Terminal, but if you have a SumUp account, you can message customer support to get the virtual terminal activated. SumUp will ask you to complete an application and submit documentation and proof of your online presence, which they will check. If all goes well, the virtual terminal will be activated for use in your account.

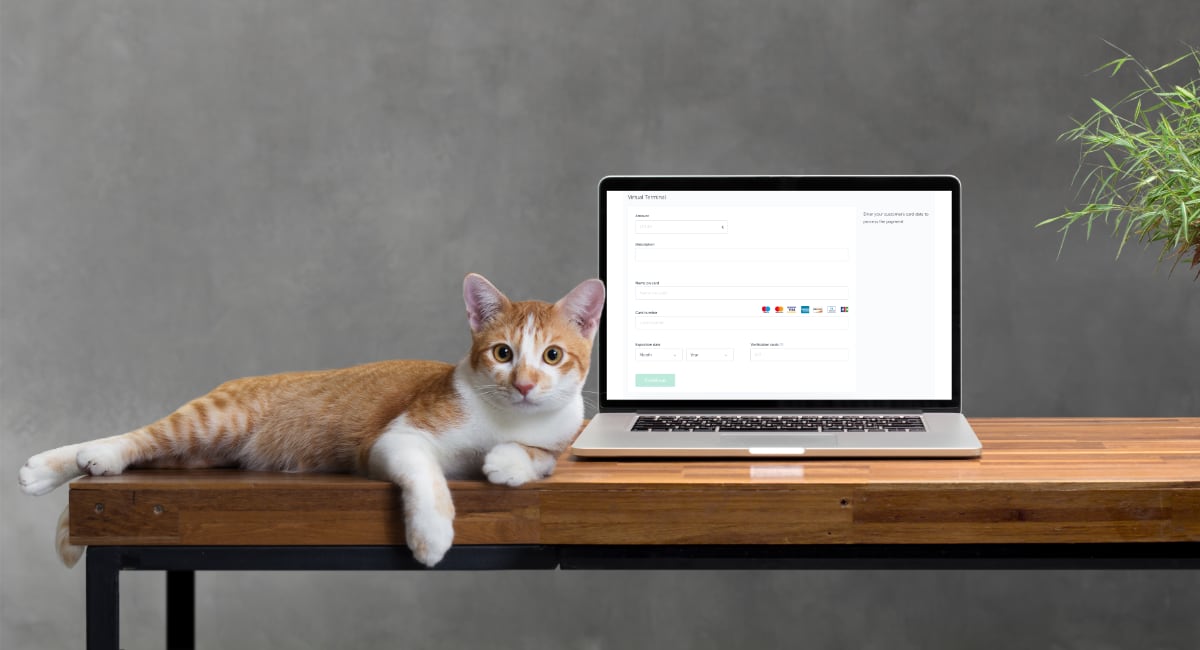

SumUp Virtual Terminal has a simple layout, in line with all of SumUp’s no-fuss products.

The virtual terminal costs nothing in monthly fees, but transactions are charged at regardless of card type or sales volume. Although higher than some other virtual terminals’ card fees, the lack of monthly costs could still mean this is the most economical solution for occasional phone payments.

SumUp merchants taking card payments through the Air or 3G card reader can benefit from keeping both face-to-face and phone payment transactions viewable in the same account, or exported to Excel for accounting purposes.

The virtual terminal accepts Visa, Mastercard, Maestro, American Express, Diners Club, Discover and JCB, which is the largest selection of accepted cards (on this shortlist) included as default.

Pricing

Monthly cost: Free

Transaction fee: for all cards

PCI compliance: No fee

There is no contract to commit to with SumUp. Once activated, you will be able to accept payments through the virtual terminal when required, but a period of non-usage may deactivate it eventually, requiring you to contact SumUp again.

The only additional information you can enter on the virtual terminal page is a short description. No customer address or other information than essential card details can be added, so it is by far the most basic option on this shortlist.

The main strength of SumUp Virtual Terminal is the fact you can use it in both SumUp App and a web browser. Most virtual terminals are only accessible in internet browsers, but SumUp’s access in their mobile app makes it ideal for on-the-go merchants with no computer access.

Best for: SumUp users requiring a simple solution for occasional over-the-phone payments.

Have you considered pay-by-links? We’ve reviewed the best UK options:

Best payment links for a small business

Summary

Which is the best virtual payment terminal, then? It comes down to how you prioritise monthly fees, contractual commitment, features and ease of use. Sales volume and type of cards accepted (credit or debit) also determine whether one provider is cheaper than another.

Strengths of virtual terminal providers:

| Virtual terminal | Best for | Website |

|---|---|---|

|

Quickest startup, no commitment, simple card rate – least hassle for a small business. | |

|

Breadth of virtual terminal features for an affordable, 30-day rolling contract. | |

|

Full range of traditional features, next-day payouts and tailored fees. | |

| Existing, medium-volume PayPal merchants using the online account as a central hub. | ||

|

Convenience for SumUp users accepting occasional telephone payments. |

| Virtualterminal | Best for |

|---|---|

| Square | Quickest startup, no commitment, simple card rate – least hassle for a small business. |

| Worldpay | Breadth of virtual terminal features for an affordable, 30-day rolling contract. |

| Takepayments | Full range of traditional features, next-day payouts and tailored fees. |

| PayPal | Existing, medium-volume PayPal merchants using the online account as a central hub. |

| SumUp | Convenience for SumUp users accepting occasional telephone payments. |