This payment solution from Barclays is pretty good but not great.

- Highs: No monthly fee or fixed commitment. Empowers on-the-go tradespeople and small businesses to accept payments from anywhere.

- Lows: Expensive rates, only accepts Visa and Mastercard, requires Barclays account for settlement.

- Buy if: You prefer to stick with a well-known banking brand.

What is Barclaycard Anywhere all about?

Barclays claims that an annual £7 billion is lost by UK SMEs by not providing a debit or credit card solution to customers. The solution? Barclaycard Anywhere. This service allows you to accept credit and debit card payments on your Android smartphone, iPhone or iPad.

You register a Barclaycard Anywhere account online, get their card reader and install an app on your smartphone and tablet, connect the card reader to your phone with the provided cable – and you are ready to accept card payments.

The transaction occurs over your device’s 3G or Wifi connection and multiple card readers can be ordered upon request. The transaction speed is comparable to an in-store reader (assuming mobile connectivity of 3G or above). Customer service is provided by Barclaycard’s existing support (phone) line.

Fees on the high side compared to competitors

The Barclaycard Anywhere card reader costs £60 (+VAT) with a 2.6% fee being charged for each transaction, plus any separate mobile data charges that may apply for usage of 3G / 4G on your phone.

This offering seems a little bit expensive when compared to iZettle, which now provides the card reader free of charge and applies a sliding scale for fees thats goes considerably lower than Barclaycard’s 2.6% from monthly turn over of £2400 and above. From £2500 in monthly transactions, Payleven‘s rate is 2.25% or lower. SumUp is also cheaper, with a flat rate of 1.95% being offered on all transactions. The SumUp PIN+ card reader comes in at £39 (+VAT) with the voucher code in this link.

Card acceptance is another limitation

It’s not just the choice of tablet that is limited, but certain cards too. Unlike its main competitors (iZettle, SumUp and PayPal Here), Barclaycard Anywhere does not currently accept American Express. Nor does it accept Diners Club, JCB and Union Pay cards, while iZettle does. If you want to hit a broad range of end users, and especially if you frequently accept foreign cards, this is another limitation.

Barclays said in early 2015 that they were expecting to add new cards, but as of September 2017, no concrete date has been announced.

Cards accepted

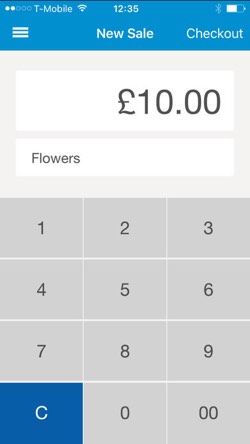

Mobile app is simplistic and outdated

A major reservation with the Barclaycards Anywhere service, is that the app actually has gotten worse.

In 2015 the app could help you manage your business, including support for sales functions, stock monitoring, customer data and payment history. The app version available in September 2017, which has not been updated since late 2016, another worrying sign, is only able to receive simple payments. There is no more till function on offer. You are not able to pre-program products. For each sale you have to add the name of the product/service and the amount.

This is perhaps not overly surprising for a bank that does not specialise in mobile applications. We’ve seen a similar move from WordPay, which eventually had to abandon its mobile point of sale app WorldPay Zinc.

The new stripped down version of the app have received an average of 1 star on iTunes App Store – a drop from the already low 2.5 stars. The Android app rating on Google Play stands on a 2.6 stars, with recent ratings all providing 1 star.

Who is the service aimed at?

Barclaycard Anywhere says the target is businesses expecting an annual card turnover of less than £1 million. In reality, businesses reaching this level of turn-over will be able to save significantly with competing card reader providers. Those reaching card transactions of £5000 should also consider a traditional terminals as long as they can commit to a 18 months contract (Barclaycard Anywhere has no lock-in).

An mPOS service like Barclaycard Anywhere is suited for start-ups, tradespeople of all kinds, small or mobile premises, seasonal traders or selling at events like concerts or trade shows.

No Android tablet compatibility

The big gap in Barclaycard Anywhere’s compatibility is that Android tablets are not currently supported. Barclays apparently has plans to introduce this functionality in the near future. According to the Barclaycard website, Android smartphones (2.3 and above) are supported, including the Samsung Galaxy S2 through to S5 (but not Galaxy Mini versions), Samsung Note, Note II and Note 3 as well as Nexus 4 and Nexus 5.

As for Apple devices, Barclaycard Anywhere is available for iPhone 4S onwards (with iOS 6.0 or above installed). The iPad 2 and above is also supported.

The verdict

As far as we could tell, Barclaycard Anywhere’s service does not offer any decisive advantages over its competition. It represents a fairly solid and convenient service, but comes with the major limitations outlined above such as higher fees, less choices of cards, a basic app, and no Android tablet support.

It appears that Barclays has decided to rely on its strong banking brand to capture more conservative businesses as well as existing customers who may prefer to stick with something that they already know. Barclays would probably claim that, due to its banking experience, the Barclaycard Anywhere solution offers a higher overall level of security, but we do not see any major difference in this area as compared to the other operators.

Overall, Barclaycard Anywhere is a decent enough service, but it could have been much better. We believe that the majority of small businesses would be better served by solutions such as iZettle or SumUp.